Tune into Success | Exploring Music Streaming Royalties Investment

Explore the fascinating realm of music streaming royalties and unlock the potential of investing in the songs you love. Join our journey as we delve into the world of music investment, where passion meets profit.

Are you a music enthusiast with an ear for investment opportunities? Imagine transforming your passion for melodies into a lucrative investment strategy. In this blog post, we’ll embark on an exhilarating journey through the fascinating realm of music royalties, where the harmonious blend of music and finance awaits.

Investing in music royalties offers a unique chance to be part of the music industry’s success story. It’s an avenue that bridges the gap between your love for music and the desire to build a diversified investment portfolio. Whether you’re a devoted music fan, an aspiring investor, or someone who recognises the power of combining passion with profit, this guide will equip you with the knowledge and insights needed to navigate the dynamic world of music royalty investment.

Music royalties encompass various types of earnings generated from music, including streaming, synchronisation, and mechanical royalties. Our focus will primarily be on digital music streaming royalties, but it’s important to understand the broader landscape of the industry. By investing in royalties, you acquire a share of the revenue generated when the songs you invest in are streamed. This means that as music continues to be enjoyed and consumed across various platforms, you can earn a portion of the royalties generated.

Throughout this guide, we’ll unravel the intricacies of music royalties investment. We’ll also weigh the pros and cons, explore diversification strategies, and delve into key considerations around investing in streaming royalties.

If you’re ready to transform from a regular music fan into a savvy, ultra-supportive music fan, then keep reading!

Understanding Digital Music Streaming Royalties

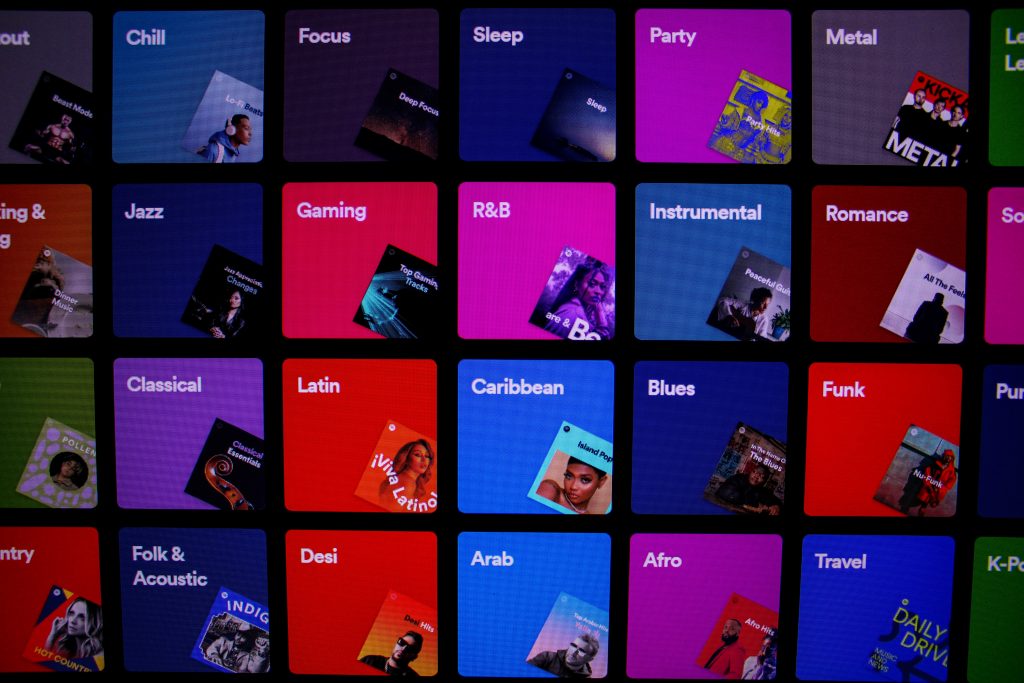

Investing in digital music streaming royalties offers a captivating opportunity to participate in the thriving landscape of streaming platforms like Spotify, Apple Music, and Amazon Music. These royalties have gained significant attention due to the rising popularity of streaming services. Let’s delve into the essence of these royalties and why they hold such appeal.

Digital music streaming royalties encompass the earnings generated when songs are streamed on platforms like Spotify. As users listen to music, rights holders, including artists, songwriters, and music publishers, earn a share of the revenue. The calculation of these royalties can vary, depending on factors like the platform’s payment model, user subscriptions, and listener location.

The streaming royalty calculation often follows a pro-rata model, where revenue from subscriptions or advertising is divided among rights holders based on the number of streams their songs receive. However, it’s important to note that licensing agreements and royalty structures differ across platforms. Rights holders may receive separate royalties for the composition and sound recording, which are then distributed to different stakeholders based on contractual arrangements and distribution models.

Investing in streaming royalties allows you to tap into the growth of the music streaming industry. As streaming continues to dominate music consumption, revenue potential from digital platforms is expected to rise. Thorough research and due diligence are essential to assess the revenue-generating potential of specific catalogues or songs you’re considering for investment.

Consider factors such as artist or song popularity, the market share of streaming platforms, and historical streaming data. These elements provide insights into the revenue potential of the royalties you wish to invest in. Staying informed about industry trends and changes will help you make well-informed investment decisions.

Weighing the Pros and Cons of Music Royalties Investment

Investing in music royalties is an enticing prospect, but it’s essential to consider the advantages and disadvantages before diving in. In this section, we’ll explore the potential benefits and drawbacks of music royalties investment, helping you make an informed decision.

Advantages

- Diversification: Music royalties offer an opportunity to diversify your investment portfolio beyond traditional assets like stocks and bonds. They provide exposure to a unique asset class that is independent of market fluctuations, allowing you to reduce overall investment risk.

- Steady Income Stream: Music royalties can provide a steady stream of passive income over the long term. As songs are streamed, purchased, or used in various media, you earn a portion of the royalties generated. This passive income potential makes music royalties an attractive option for those seeking recurring revenue.

- Potential for High Returns: Investing in successful songs or catalogues can yield substantial returns. Popular songs with a strong fan base and extensive streaming or licensing potential can generate significant royalty income. However, it’s important to note that the returns are not guaranteed and can vary depending on the performance of the music.

- Emotional Connection: For music enthusiasts, investing in music royalties offers a unique emotional connection to the art form they love. Supporting artists, songwriters, and the music industry as a whole can be personally rewarding, adding an extra layer of fulfilment to your investment journey.

Disadvantages

- High Risk and Uncertainty: Investing in music royalties carries inherent risks. The success of a song or catalogue can be unpredictable, and returns are dependent on factors like popularity, streaming trends, and the changing music landscape. It’s crucial to recognise that not all music royalties will generate substantial income.

- Limited Control: As an investor, you have limited control over the performance and success of the songs or catalogues you invest in. Factors like changing consumer preferences, competition, and evolving industry dynamics can impact the revenue potential of your investment.

- Complex Royalty Structures: Royalty structures in the music industry can be complex and challenging to navigate. Understanding the intricacies of royalty calculations, distribution mechanisms, and contractual obligations requires expertise or professional advice.

- Long-Term Commitment: Music royalties are typically long-term investments, and it may take time to realise significant returns. If you’re seeking quick liquidity or short-term gains, music royalties may not align with your investment objectives.

- Market Volatility: While music royalties are not directly tied to market fluctuations, broader economic conditions can still indirectly impact the music industry. Economic downturns or changes in consumer spending habits can affect music consumption and, consequently, royalty income.

By weighing the advantages and disadvantages of music royalties investment, you can make an informed decision that aligns with your financial goals, risk tolerance, and personal interests.

Diversifying Your Musical Investments

When it comes to investment, diversification is a key principle that helps mitigate risk and optimise returns. Adding music royalties to your investment portfolio can be a smart way to diversify and potentially enhance your overall financial strategy.

Diversification involves spreading your investments across different asset classes and sectors to reduce exposure to any single investment. By diversifying, you aim to capture the potential gains from various sources while minimising the impact of any individual investment’s performance. Including music royalties in your portfolio offers a unique opportunity to tap into the music industry’s potential while adding an alternative asset class to your investment mix.

Investing in music royalties can help diversify your portfolio in several ways.

Firstly, it introduces exposure to the entertainment and media sector, which may have a different risk and return profile compared to traditional assets such as stocks or bonds. This diversification can provide a buffer against market volatility and enhance the resilience of your portfolio.

Secondly, music royalties offer a non-correlated asset, meaning their performance is not directly tied to the fluctuations of financial markets. While stock prices and bond yields may fluctuate with economic conditions, the popularity and consumption of music can exhibit more independent behaviour. By incorporating non-correlated assets like music royalties, you can potentially reduce the overall risk of your portfolio and enhance its stability.

Thirdly, investing in music royalties allows you to tap into the income potential of the music industry, particularly digital music streaming royalties. As the popularity of streaming platforms continues to rise, the revenue generated from streaming is expected to increase. This income stream can provide a consistent and potentially passive source of returns, contributing to the overall income generation of your portfolio.

However, it’s important to note that diversification does not guarantee profits or protect against losses. Investing in music royalties still carries risks, and it’s crucial to assess the specific opportunities and potential returns on a case-by-case basis. Thorough due diligence, research, and professional advice can help you navigate the complexities of the music industry and identify suitable music royalty investments that align with your investment goals and risk tolerance.

Key Factors to Consider When Investing in Music Royalties

Before you dive into the world of digital music streaming royalties, there are several factors to consider to make informed investment decisions. Here are a few essential aspects to keep in mind:

Research and Due Diligence

Thorough research is paramount before investing in music royalties. Understand the performance history of the songs or catalogues you’re considering, evaluate the popularity and streaming trends, and assess the potential for future revenue generation. Look for credible sources of data and consider consulting professionals who specialise in the music industry and royalty investments.

Rights and Ownership

Clarify the rights and ownership associated with the music royalties you plan to invest in. Determine whether you’re investing in the composition (songwriting) rights, sound recording rights, or both. Understand the contractual obligations, licensing agreements, and royalty collection societies involved. It’s important to have a clear understanding of the rights you’ll be entitled to and how royalties are distributed.

Diversification

As we mentioned previously, diversification in investment is vital. When investing in music royalties, you should continue to diversify.

Consider spreading your investments across different songs, catalogues, or genres to mitigate risks. Diversifying your portfolio of music royalties can help balance potential upsides and downsides and reduce exposure to the performance of a single song or artist.

Long-Term Potential

Investing in music royalties is often a long-term commitment. Assess the long-term potential of the songs or catalogues you’re interested in. Look for timeless classics, songs with enduring appeal, or emerging artists with promising careers. While there are no guarantees, investments with long-term potential can provide more stability and potential for sustained returns.

Industry Trends and Technology

Stay updated on industry trends and technological advancements that may impact the music royalties landscape. The music industry is constantly evolving, with new platforms, streaming services, and licensing models emerging. Be aware of how these changes can influence royalty calculations, revenue streams, and the overall market for music royalties.

Professional Guidance

Consider seeking advice from professionals experienced in music royalty investments. They can provide insights and expertise, and help navigate the complexities of royalty agreements, licensing, and royalty collection societies. A qualified advisor can assist you in making informed decisions and avoiding potential pitfalls.

Wrapping Up

Investing in digital music streaming royalties offers a unique opportunity for music enthusiasts to combine their passion with financial gains. By understanding the intricacies of buying these royalties and carefully evaluating investment opportunities, you can tap into a market that has the potential to provide both musical and financial rewards.

Support your favourite artists, get connected to the music industry in an exciting and valuable way, and enjoy passive income from diverse investments. Go from being a regular music fan to one that really is in on the action!

Sign up to Fractis today, and be first in line to invest in music streaming royalties in an exciting and innovative way.