Just How Decentralised Is Solana?

Solana is an alternative to blockchain giant, Ethereum. But, there are questions around exactly how decentralised this digital ledger is. Steps are being continually taken to quell these concerns.

There are a number of reasons why blockchain technology is preferable over traditional banking and data processes. A huge one is decentralisation – something that Solana hasn’t quite mastered… yet.

Table of Contents

What Is Solana?

Decentralised Explained

Solana & Decentralisation

Becoming Decentralised

Future Improvements

What Is Solana?

Solana is a blockchain company. What’s a blockchain? It’s a decentralised digital ledger (DLT) that holds a secure record of transactions and data, which is publicly visible. There are a number of blockchains out there, and each has its own strengths and goals. Solana’s value proposition is to be the fastest blockchain.

Alongside being superfast, Solana is also known as a solid alternative to Ethereum due to its incredibly low transaction fees. But, providing affordability and speed means something has to give somewhere else. In this case, it’s decentralisation.

Decentralisation Explained

If you want to send a large sum of money to a friend on the other side of the world, usually you’d need to contact your bank. The bank – a private organisation – acts as an intermediary for this transaction. They take a large fee to perform the transaction. You won’t get to see the ins and outs of it, and have to put all your trust in them that things will go smoothly. If your bank tanks, your mortgage, savings, financial security could suddenly be pulled out from under you.

This is an example of something that is very centralised.

Understandably, the thought of this doesn’t sound very attractive, not when it’s laid out like that. But, it’s something we’ve been living with as normality for all our lives.

Enter blockchain technology, and a decentralised alternative.

What makes DLT decentralised is the fact that the activities, particularly decision-making, is in the hands of many participants, rather than one governing group. The cornerstone of blockchain is the consensus mechanism – examples of this are Proof of Work and Proof of Stake.

Transactions are validated and added as data to the blockchain by computers (nodes) in the network. A majority agreement must be met before a transaction is validated. In Proof of Work, validators are called miners, and they solve complex cryptographic puzzles. Proof of Stake relies on validators staking tokens before validating transactions – a less energy hungry method.

Solana & Decentralisation

So, what’s up with how decentralised Solana is, and why is it a stumbling block for some people?

Validators & Vulnerability

Putting the decision-making into the hands of more people makes a network more decentralised. In Solana’s case, it has far fewer validators (decision-makers) than blockchains like Ethereum. Why does this matter?

It matters because in order to hack and corrupt a network, you need to have the majority vote. The fewer nodes voting, the fewer bad actors needed to successfully corrupt a blockchain. These sorts of attacks result in networks being halted, sometimes for hours at a time.

Adding more validators seems like the obvious solution here, but the thing with blockchain technology is that it just isn’t that simple. More validators would cause transaction time to increase, which could also lead to an increase in fees. These are the two things Solana is best known for – so that’s a no-go.

Private vs Public Tokens

Nearly every blockchain has a maximum amount of tokens they can mint – that’s the max supply. The tokens in circulation are divvied up and made available to certain groups. These groups include insiders (the company team, venture capitalists), foundations, community allocations, and public sale.

Very simply put, the fewer tokens allocated to insiders and foundations, and more to the public, the more decentralised a network is. Almost 50% of Solana’s initial token allocation was for insiders and foundations. The below graphic from Messari, although a year old, illustrates this well.

Having half of a network’s tokens essentially owned by the network, it starts to lean things towards centralisation.

Becoming More Decentralised

We’re certainly not hating on Solana – far from it. Compared to traditional banking practises, Solana can still be considered decentralised. Plus, there’s a good reason Solana has fewer nodes (making it faster) which ultimately equals being more centralised.

Using the Proof of Stake consensus mechanism, as Solana does, makes the network considerably more environmentally friendly than the likes of Ethereum. If you’re interested in learning more about the differences between these two networks, check out our article.

Validator Victory

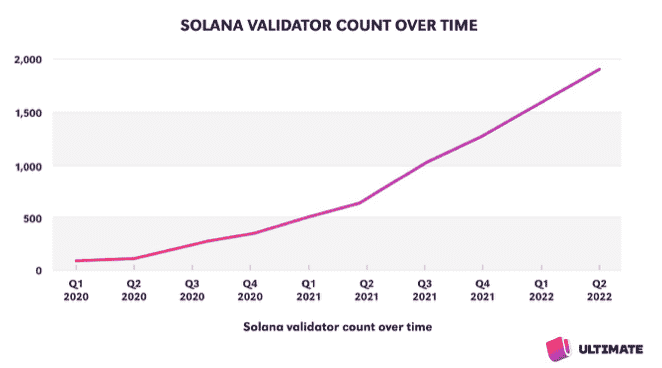

Solana reached a new milestone recently, and became the Proof of Stake network with the highest number of active validators.

This is great news in terms of stepping closer to being more decentralised. There are some concerns about the geo-diversity of these validators, however. Since they are predominantly based in Germany and the US, the network is dependent on those territories’ regulatory regimes.

Future Improvements

It’s worth remembering that Solana’s mainnet is still in beta. That means that plenty of work is going into improving processes and ironing out any bugs. Fixes are being shared that should reduce the number of outages the network experiences in future.

These server improvements, paired with growth in the number of validators means that Solana could iron out the kinks that keep people from leaping from Ethereum to the Solana network.

At Fractis, we’re excited to be built on a blockchain that champions a ccessibility without compromising the planet. Check out what we’re all about right here!